Impact of Artificial Intelligence on the Financial Ecosystem

Banking is a crucial sector. AI significantly changes the traditional operating models of financial institutions as it faces hard challenges on multiple fronts. A lot of opportunities came for the finance industry with the latest inventions.

To give banking a proper structure and approach, AI has the potential to lead to high-cost savings and better assess loan risks. According to research, banks can use AI banking tools to increase transactions by two and a half times while maintaining the same headcount.

This trending technology gives finance a boost to improve fraud detection and claims processing to make the process smoother and safe.

In this Blog, we will give our target audience proper guidance on how to finance better embraces AI and prepare them for the future. Let's understand.

Market Analysis of AI in the Global Market

The global AI in the banking market is usually based on component, enterprise size, application technology and region. According to the study, In 2020, 32% of the banks already used AI applications such as predictive analysis, voice recognition and many more.

The market size was valued at 3.88 billion in 2020 and it is expected to increase by 64 billion by 2030 in the coming ten years. It is a great achievement for retailers and businessmen in the coming years to make their systems stronger and get over through day-to-day challenges.

Benefits of AI in Financial Institutions

As we know, AI is being used widely across the finance industry. So, here we will discuss the benefits of AI in the financial sector.

- Reliable Risk Management

When it comes to risk assessment, manual errors occur most of the time. Finance is a tough platform that deals with securities, insurance products and debts. With the integration of AI-enabled systems, the risk will be managed and reduction in the manual errors that occur by humans.

- Better Credit decision

AI is effectively used better to make informed decision-making processes. It helps to identify applicants who are not added and those that lack any reliable credit history. This process helps to make the right credit decision and turn from high profitability to non-performing loans.

- Fraud Detection

Finance is a critical sector that can be easily influenced by unauthorized users to make transactions with other parties. With excessive growth in digital customer transactions, a reliable fraud detection model is required to safe transactions process and feel free to make payments.

- Personalized Customer Experience

With the introduction of new technology trends, AI in financial sector is coming up with innovative digital approaches that make it different from other sectors.

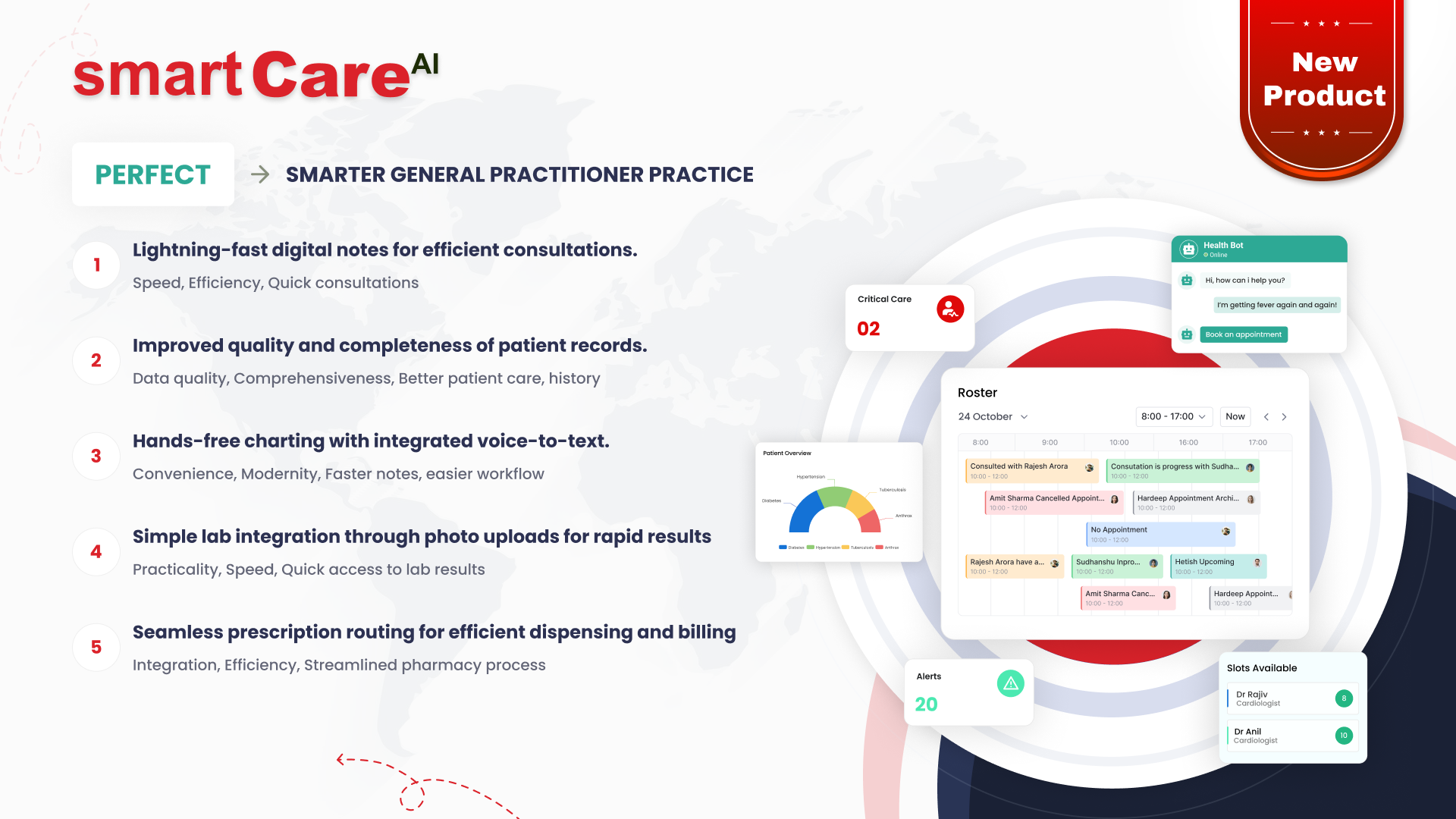

Chatbots and live chat software become the first point of contact for users who are looking for customer support. These are AI programs that work on preset rules and are integrated with deep learning capabilities.

- Cybersecurity

This term plays an important role in every field as security is a prominent factor that should be considered first. With the help of AI Bots, criminals or fraudsters can be detected easily and get the complete record of the person.

- Automation

Automation helps to increase operational efficiency while reducing costs. The automation in banking and finance enables various enhancements like customer onboarding process, application processing, fraud detection etc. This will be helpful to make a safer transaction for other parties.

- Quantitative Trading

AI provides the advantage to observe patterns from the previous data that make the predictions that will be possible in future. This new trend is capable to personalize investment for particular investors to make decisions.

How smartData develops AI-based solutions for Finance

Automate and advance your business objectives with our innovative AI-driven solutions. We are a leading software development company with expertise in various technologies stack.

smartData software development experts understand the needs of the clients and build innovative solutions to anticipate your business outcomes in real-time. We integrated the best AI algorithms to establish the minimum and maximum levels for stock holding units.

We have expertise in developing stock trading software and focus on the latest technology trends that meet your requirements ranging from stock marketing to secure digital payments. Our solutions will be an excellent choice for both beginners and experienced users.

To get the top solutions for your trading business or investing money in stocks. Invest your time with our experts to fulfil your desired financial needs.

Future Trends of AI in the Financial Sector

Artificial intelligence is introducing new methods that transform finance's original structure in the coming years. The changes are so drastic that they will become completely unrecognizable.

Integration of AI-enabled systems enables better learning algorithms and a shorter time to value. Organizations begins to require more from AI systems and started figuring out how they can change their methods more appropriately.

Systems that are powered with AI are more powerful, efficient and reliable. Technologies are figuring more applications in the world of finance and are widely adopted by retailers and bankers. The operations are more streamlined and much more productive to maintain the future goals of the organization.

Conclusion

Lastly, the collaborative framework of AI brings business and technology leaders together and creates value for the enterprise. It will strengthen an organization's performance in terms of speed efficiency and productivity. This innovation creates more opportunities for various talents who can create and optimize artificial intelligence technologies.

It offers banks and finance industries an opportunity to maximize their impact of technology capabilities that count for customers. The AI bank innovation strives towards a more intelligent value proposition and smarter experiences. Choose the more refined ways to make your banking system strong and highly acceptable by the users.