Posted On May 14, 2019

FinTech to RegTech: Technological Advancements

Digital change is fast and technological breakthroughs ubiquitous. Technology is being adopted on a massive scale in several industries and one such prominent industry is the financial sector. The revolutions are quick here. With more than 7000 startups in Fintech all around the globe, increased transition to open, API based technology architectures; banks and other financial institutions are moving away from the traditional banking ways.

New markets are bound to be explored but sending and lending money still remains a risky business. RegTech, on the other hand, takes advantage of technological advancements, characterized by agility, speed, and analytics to make the system more secure and fraud-free.

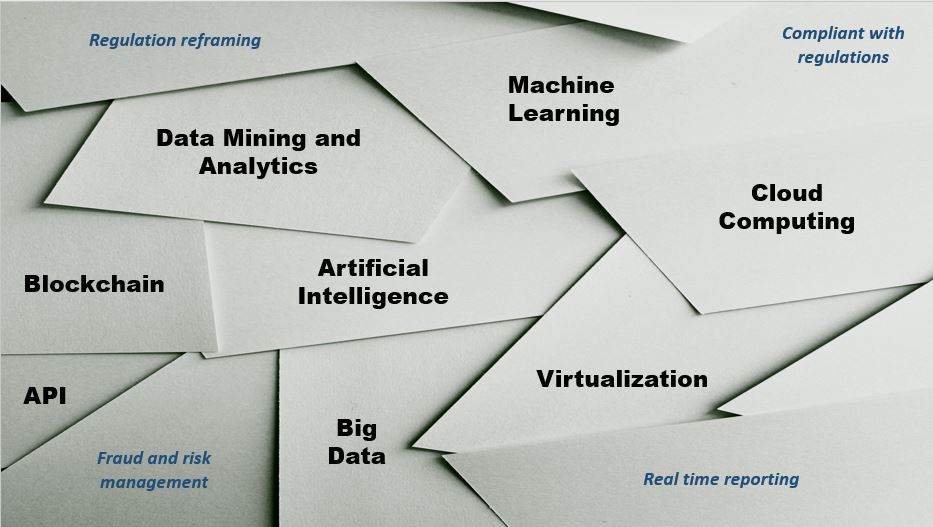

What is RegTech? RegTech or Regulatory Technology manages regulatory processes within the financial industry through technology. What does RegTech do? To name a few regulation monitoring, reporting, and compliance governance. Why RegTech? With the rise of digitization, data breaches have increased and fraud management has become more complex. RegTech reduces the risks for financial companies by monitoring online transactions in real time to identify irregularities in the digital payment domain. How? Leveraging technologies like cloud computing, big data and machine learning RegTech analyses huge chunks of data to predict potential risk areas that a financial institution should focus on thus saving time and money.

A new era of regulations:

RegTech is already making its presence felt and financial sectors are looking into greater improvements. The RegTech revolution is scaling and the new trending technologies are only accelerating the growing need for regulations.