Posted On July 16, 2024

Fintech: Innovation in projects

Innovation in fintech is flourishing around the world, and it’s not just technological advancement rather making financial services more accessible, convenient, and secure. In recent years, India has also seen significant innovation in fintech, driven by the combination of technological advancement, supportive government policies and regulatory support makes it towards digital economy. Here are some notable innovations in Indian fintech projects:

Here are some notable innovations in Indian fintech projects:

-

Banking for everyone

Fintech companies are playing a crucial role in bringing banking services to every people, specially in those are not required to come bank for small small things. automated teller machine (ATM) and currency vending machines are the innovations by fintech to providing services to those area, where there are not many banks.

-

UPI (Unified Payments Interface)

UPI was launched by National Payments Corporation of India (NPCI). It is a digital payment method enabling instant fund transfers between bank accounts via mobile phones. Sending money through phone has become popular, and many apps are using it too. This has been a big advancement in fintech.

-

Aadhaar enabled Payment System or AePS

It is again a product of the house of National Payments Corporation of India (NPCI), Aadhaar card holders now can make payments, transfer funds, make withdrawals, deposit cash and other bank related activities by using Aadhaar based authentication.

-

Digital Wallets

Fintech companies like Paytm and PhonePe let you store money electronically in your phone, like in purse. You can use it to pay for things online and in stores, and some even let you pay bills, shop online, or even invest.

-

Microfinance and Peer-to-Peer Lending apps

Companies in the fintech industry are making it easier for people to get loans who otherwise might not qualify at a regular bank. This includes small loans, borrowing money from people directly, and getting loans for things like phone bills. Mobikwik and CRED are the leading such companies in the fintech category and providing loans to more people who are needed.

-

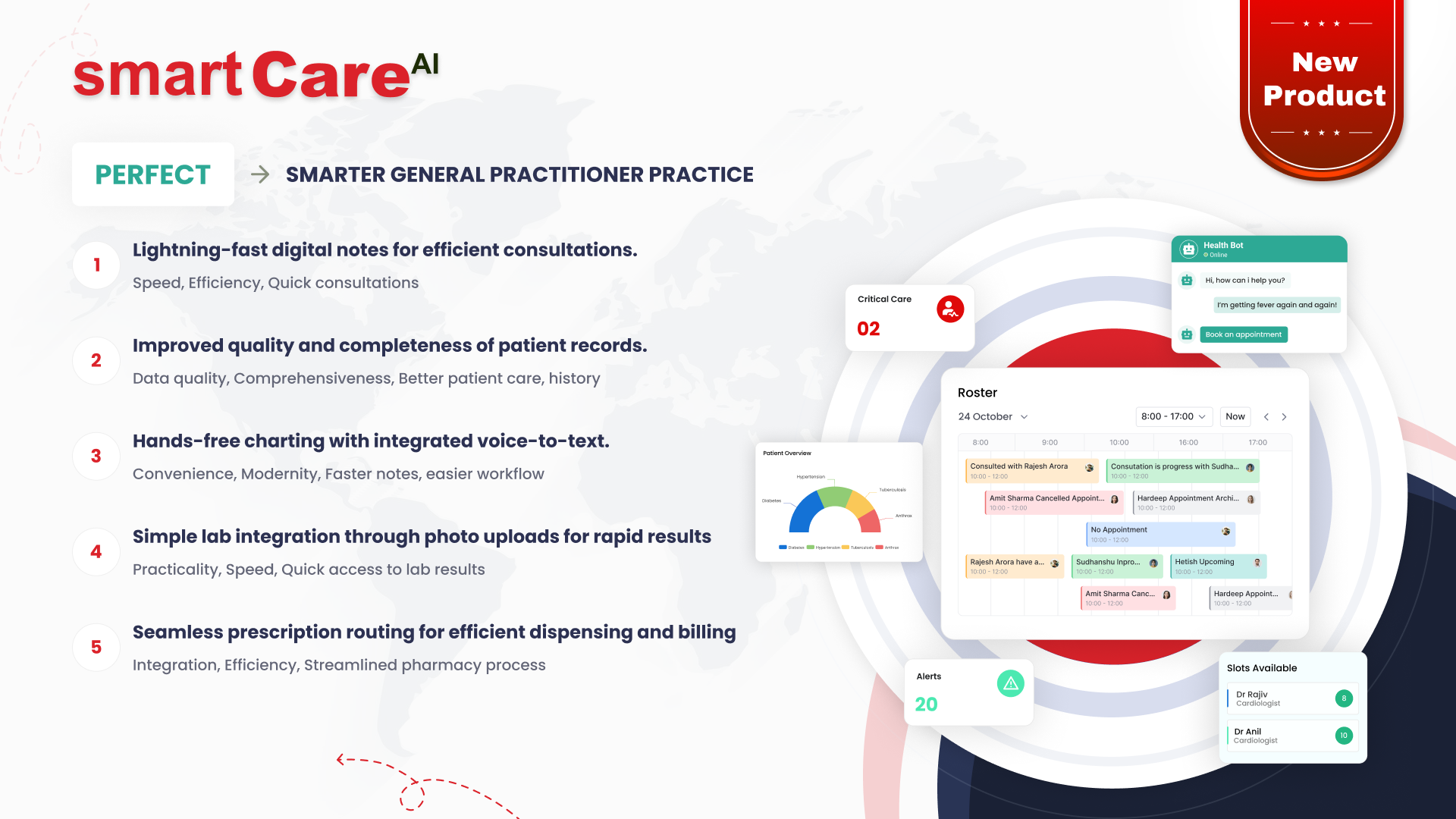

AI based investment advisory apps

Fintech startups have introduced AI based investment advisory services that use algorithms to provide personalized investment advice based on user preferences. This is making investing more accessible to retail investors. Sensibull, Zerodha Kite, Upstock, Angle broking and 5paisa are a few examples.

-

Blockchain and Cryptocurrencies

Cryptocurrencies have seen regulatory challenges in India. Blockchain technology is not only about cryptocurrency. Fintech companies are using it for tracking products for supply chain industries as well as making contracts which can’t be modified or tempered with. Some of the cryptocurrencies app in India are WazirX, CoinDCX

-

Fintech in insurance sector

The insurance industry is changing with the adaptation of the fintech industry. New online platforms, AI that helps process claims faster, and personalized insurance plans based on your situation are all making things smoother policybazaar.

-

Credit Scoring and Lending

Specialised tech tools are being created to help banks to follow regulations easily and affordably. Cibil a credit information company helps bank to follow the guidelines and check credit history of the borrower. Many companies like paisabazaar share credit rating to individuals and help their customers to get bank loans.

-

Sharing financial information safely

New initiatives are making it easier and safer to share your bank information with financial institutions. This will allow for even more innovative financial products and services in the future.

These new fintech innovations not only meet the changing needs of people but also help the overall economy grow. They are making it easier for peoples to manage their money and improving the entire financial system.